Table of Content

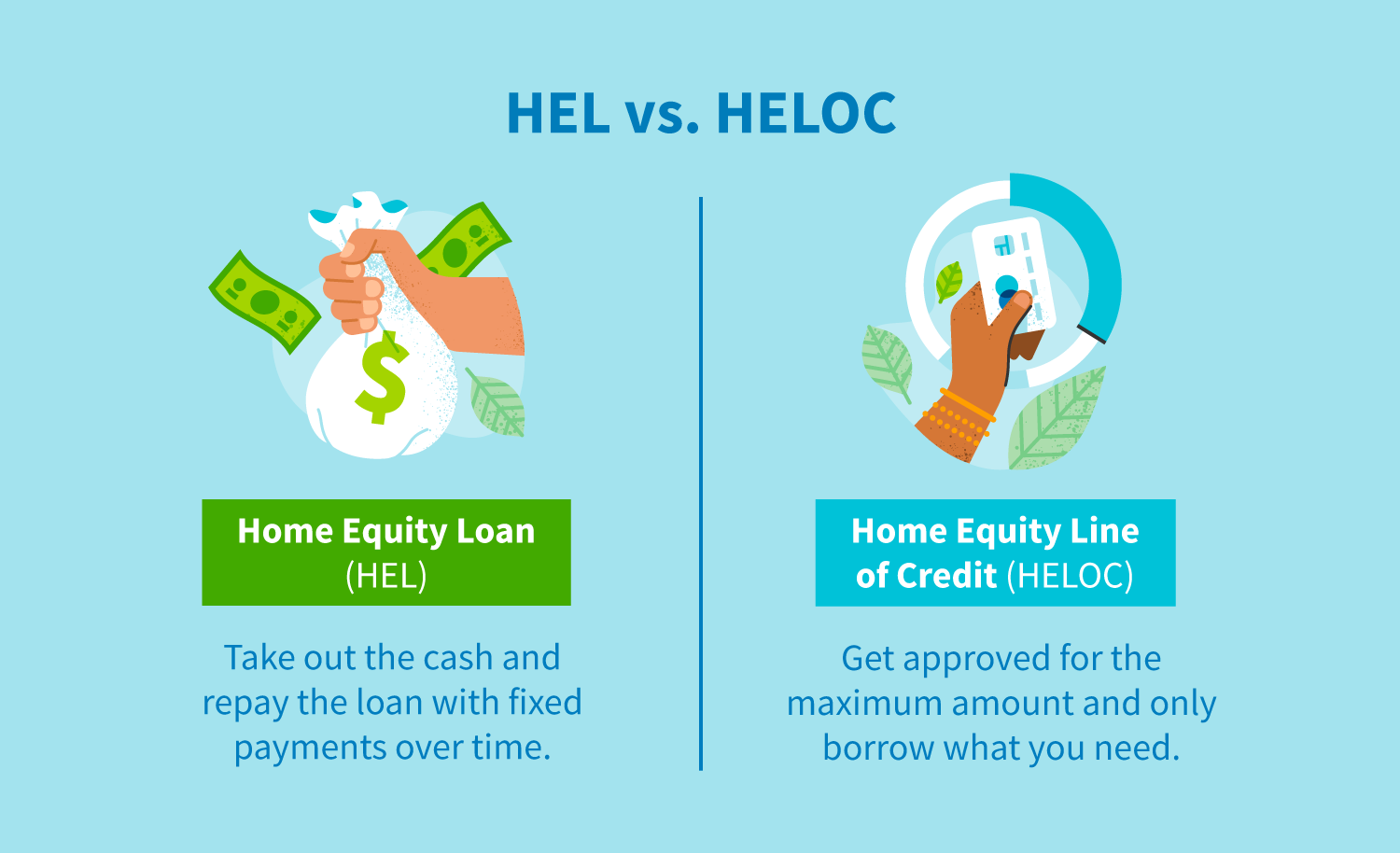

This can make a HELOC a bad choice for individuals on fixed incomes who have difficulty managing large shifts in their monthly budget. HELOCs allow borrowers to spend as much or as little of their credit line as they choose and may be a riskier option for people who can’t control their spending compared to a home equity loan. Home equity loansandhome equity lines of credit are loans that are secured by a borrower’s home. A borrower can take out an equity loan or credit line if they have equity in their home. Equity is the difference between what is owed on the mortgage loan and the home’s current market value. In a standard home equity loan, there is a predetermined repayment term, just like a regular mortgage.

The lender changes up the terms of your loan, such as your interest rate, right before closing, under the assumption that you won't back out at that late date. You risk losing your home to foreclosure if you fail to make loan payments. You’ll probably pay less interest than you would on a personal loan, because a home equity loan is secured by your home. A home equity loan is a type of second mortgage that allows you to borrow against your home’s value, using your home as collateral. However, an owner can leverage their home equity as collateral in a variety of ways to secure low-cost funds for their financial needs. If a homeowner purchases a home for $100,000 with a 20% down payment (covering the remaining $80,000 with a mortgage), the owner has equity of $20,000 in the house.

What percentage of your income should go towards your mortgage

Home equity loans allow homeowners to borrow against the equity in their residence. A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Information provided on Forbes Advisor is for educational purposes only.

Racking up credit card debt can cost you thousands in interest if you can’t pay it off, but becoming unable to pay off your HELOC or home equity loan can result in losing your home. A reverse mortgage lets you borrow one lump sum, a line of credit, or fixed monthly payments against your home’s equity. That last option is why it’s called a reverse mortgage—instead of you paying the bank each month, they pay you. Home equity loans are also frequently used to consolidate high-interest debt, like credit card debt. Since home equity loans are secured by your home, they usually have lower interest rates than you’ll find on unsecured loans, such as credit cards or personal loans.

Pros and Cons of a Home Equity Loan

Many people who want to start their own business may not have the funds to do so, which is why home equity loans may be an option to explore. Whether you want to start a company from scratch or open a franchise, home equity loans can help you access money that you may not have had in your personal savings account. Home equity is commonly used to pay off personal debt and help you manage monthly bills. Taking out these loans can help you consolidate high-interest debt at a lower interest rate. Paying off debt over a longer term could reduce your monthly expenses by a significant amount. A Lender will typically allow you to borrow a total of 80% of the current value of your home.

These can range from 2% to 5% of your loan amount, which could significantly eat into your cash reserves. A home equity loan is essentially a second mortgage that lets you borrow against your home’s equity, which is the difference between what your home is worth and what you still owe on your first mortgage. Home values have risen substantially over the past two years, making home equity loans -- which provide you with a lump sum of cash at a fixed interest-rate -- an appealing option for many.

Pros and Cons of Home Equity Loans

Thus, the amount you can borrow will be diminished with each new loan. Replaces your current mortgage with a new mortgage that has more favorable rates and terms. The equity you borrow is added back onto the balance of your new mortgage and you pay it off over your loan term.

You need to have a minimum amount of equity to qualify for a home equity loan. Many lenders will have a loan-to-value limit for a home equity loan, which means that the more equity you have, the larger the amount you’ll be able to borrow. The loan-to-value ratio is the total amount of debt on the home compared to its worth, a measure of equity. For example, if you owe $200,000 on your mortgage but the home is worth $250,000, your LTV ratio is 80% and equity is 20%. The interest you’ll pay on a home equity loan is typically higher than what you’ll find on a 30-year fixed mortgage.

How Can I Get a Home Equity Loan?

Generally speaking, most home equity lenders will only let you borrow up to 85% of your home’s value in total between your mortgage and a home equity loan. You'll need a good credit score and adequate income to qualify for a home equity loan. Home equity loans have a fixed interest rate, while HELOC interest rates are variable.

A home equity line of credit is a revolving line of credit, usually with an adjustable interest rate, which allows you to borrow up to a certain amount over a period of time. HELOCs work like credit cards, where you can continuously borrow up to an approved limit while paying off the balance. Not all lenders offer home equity loans or HELOCs for investment properties because they tend to be riskier. The more lenders you interview, the better your chances of finding the most favorable rates and terms. Some lenders may offer lower interest rates that appear less expensive, but include higher fees that could cancel out any potential savings.

Similar to a mortgage, a home equity loan is a debt that’s secured by the equity in your house or apartment. If you’re not familiar with the term “equity,” it’s the amount that your home is currently worth, minus any debt you have on it in the form of a mortgage or other loans. Usually a home equity loan serves as an additional debt on top of an already existing mortgage. That means that over time, your interest rate can rise, making your HELOC payments more expensive and harder to keep up with. And if you fall really far behind on your HELOC payments, you could actually put yourself at risk of losing your home. HELOCs, on the other hand, offer a revolving line of credit to tap as needed.

In the United States until December 31, 2017, it was possible to deduct home equity loan interest on one's personal income taxes. As part of the 2018 Tax Reform bill signed into law, interest on home equity loans will no longer be deductible on income taxes in the United States. If mortgage rates have dropped substantially since you took out your existing mortgage—or if you need the money for purposes unrelated to your home—you should consider a full mortgage refinance. The interest rate on a mortgage can be fixed or variable .The borrower repays the amount of the loan plus interest over a fixed term; the most common terms are 15 or 30 years. A mortgage calculator can show you the impact of different rates on your monthly payment.

When your old home sells, the proceeds will first pay off your remaining mortgage balance, then your home equity loan. A home equity loan is a loan for a set amount of money, repaid over a set period of time that uses the equity you have in your home as collateral for the loan. If you are unable to pay back the loan, you may lose your home to foreclosure.

A home equity loan is often referred to as a second mortgage because that's truly what it is. Often, this type of loan can be a way for homeowners to access large sums of money to pay for life's big expenses. It's not uncommon to see someone take out a home equity loan to finance home improvements, to cover medical debts, or to assist a child in paying for his or her education. Closing costs range between 2% and 5% of the loan amount, which is typically lower than closing costs on a purchase mortgage and even slightly lower than closing costs on a cash-out refinance. A home equity loan functions much like a mortgage where you’re provided a lump sum up at closing and then you begin repayment. Every month, you’ll make the same payment amount, which is a combined principal and interest payment, until your loan is paid off.

No comments:

Post a Comment